Ready or not, it's time to move forward. Embracing digital transformation is essential for staying ahead and driving sustainable growth.

Create your account today Download AppSafe Download Notice

You may see a message saying

File might be harmful

when downloading the app.

This is a normal Android warning for apps downloaded outside of Google Play. The Orbyle App is hosted safely on

orbyle.com.

Use ORBYLE as your official CBA, complete with financial statements and BIR tax form guidance.

Itemized Deduction (3%)

Eight Percent (8%)

Optional Standard Deduction (40%)

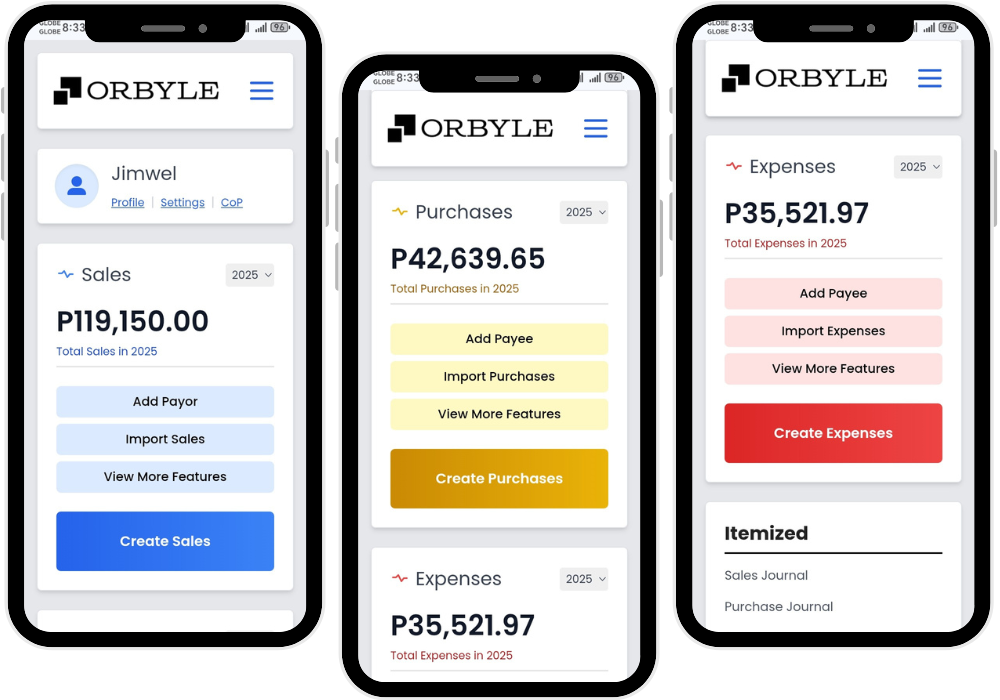

Manage your accounts anytime, anywhere - on mobile, tablet, or PC.

For micro taxpayers not VAT-registered. Simplified tax on gross sales/receipts.

NIRC Section 109 - 116

Optional tax for self-employed or professionals with gross receipts up to ₱3M.

NIRC Section 24 - 109, TRAIN Law

Deduction for business expenses under the regular income tax scheme.

NIRC Section 34 - 109